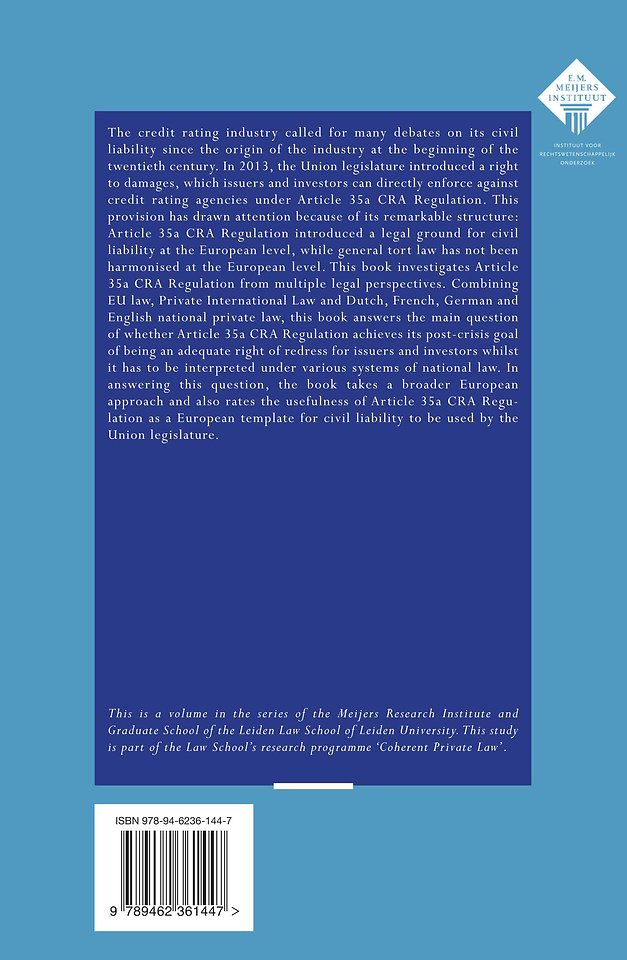

Credit rating agency liability in Europe

Rating the combination of EU and national law in rights of redress

Samenvatting

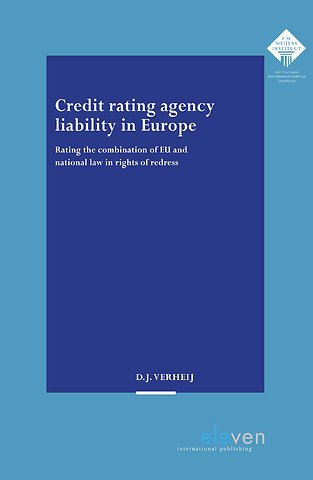

The credit rating industry called for many debates on its civil liability since the origin of the industry at the beginning of the twentieth century. In 2013, the Union legislature introduced a right to damages, which issuers and investors can directly enforce against credit rating agencies under Article 35a CRA Regulation. This provision has drawn attention because of its remarkable structure: Article 35a CRA Regulation introduced a legal ground for civil liability at the European level, while general tor t law has not been harmonised at the European level.

This book investigates Article 35a CRA Regulation from multiple legal perspectives. Combining EU law, Private International Law and Dutch, French, German and English national private law, this book answers the main question of whether Article 35a CRA Regulation achieves its post-crisis goal of being an adequate right of redress for issuers and investors whilst it has to be interpreted under various systems of national law. In answering this question, the book takes a broader European approach and also rates the usefulness of Article 35a CRA Regulation as a European template for civil liability to be used by the Union legislature.

Trefwoorden

Specificaties

Inhoudsopgave

1 INTRODUCTION 1

1.1 Context 1

1.2 Civil liability of credit rating agencies 2

1.3 Research questions

1.4 Methodolody 6

1.5 Scope and demarcations 9

1.6 Relevance 10

1.7 Relationship to other research 11

1.8 Outline 14

2 INFLUENCE OF EU LAW ON CIVIL LIABILITY 17

2.1 Introductory remarks 17

2.2 Competence of the European Union 18

2.3 Effects of EU law in national legal orders 21

2.3.1 Direct effect 21

2.3.2 Regulations 23

2.3.2.1 Direct applicability does not entail direct effect 23

2.3.2.2 ‘Sufficiently clear, precise and unconditional’ 24

2.3.2.3 Provisions requiring additional (national) measures 25

2.3.3 Directives 29

2.4 Enforcement of EU law 32

2.4.1 Rights, remedies and procedures 32

2.4.2 National procedural autonomy 33

2.4.3 Equivalence and effectiveness 33

2.5 Influence of EU law on civil liability 34

2.5.1 Categorisation 34

2.5.2 Situation 1: Absence of EU law provisions on civil liability 36

2.5.2.1 Setting the scene 36

2.5.2.2 Regulations 37

2.5.2.3 Directives 41

2.5.3 Situation 2: EU law provisions on (the application of) national civil liability regimes 49

2.5.3.1 Setting the scene 49

2.5.3.2 EU law provisions (de facto) requiring application of national civil liability regimes 50

2.5.3.3 EU law provisions creating a right of redress under national law 55

2.5.4 Situation 3: EU law provisions creating directly effective rights to compensation or damages 58

2.5.4.1 Setting the scene 58

2.5.4.2 A directly effective right to damages with reference to national law: Art. 35a CRA Regulation 59

2.5.4.3 Autonomous right to compensation: Art. 82 GDPR 67

2.5.5 Overarching influence of effectiveness 68

2.6 Concluding remarks 71

3 CREDIT RATING INDUSTRY AND ITS REGULATION 75

3.1 Introductory remarks 75

3.2 Historical perspective credit rating industry and civil liability 76

3.2.1 Origins: credit reporting agencies, financial press and the first credit rating agencies 76

3.2.2 Expansion: regulatory purposes, issuer pays and structured finance 78

3.2.3 Inaccurate credit ratings and (self-)regulation 80

3.2.4 Global financial crisis, regulatory frameworks and liability threats 82

3.2.4.1 Financial crisis 82

3.2.4.2 Possible causes of inaccurate structured finance ratings 84

3.2.4.3 Aggravated effects due to overreliance 85

3.2.4.4 Legal developments 86

3.2.5 Recovery and settlements 91

3.3 Credit ratings 94

3.3.1 Character and types 94

3.3.2 Assignment of credit ratings 95

3.3.2.1 Formal proceedings 95

3.3.2.2 Rating methodologies 96

3.3.2.3 Structured finance products 98

3.3.3 Functions 100

3.3.4 Effects 102

3.3.4.1 Credit ratings, credit risk and investor compensation 102

3.3.4.2 Empirical evidence bond and structured finance markets 104

3.3.4.3 Empirical evidence from equity markets 106

3.4 EU regulatory framework 107

3.4.1 Objectives 107

3.4.2 Preliminary provisions 108

3.4.2.1 Scope of application 108

3.4.2.2 Reducing overreliance 110

3.4.3 Substantive rules 111

3.4.4 Public enforcement by ESMA 112

3.5 Private enforcement of Article 35a 114

3.5.1 Legislative history 114

3.5.1.1 Situation prior to Article 35a 114

3.5.1.2 Public Consultation on Article 35a 114

3.5.1.3 Impact Assessment 116

3.5.1.4 EC Proposal & amendments 117

3.5.2 Conditions for civil liability 118

3.5.3 Stakeholders defined and scope of application 119

3.5.3.1 ‘Credit rating agency’ 119

3.5.3.2 ‘Issuer’ 121

3.5.3.3 ‘Investor’ 121

3.6 Factual perspective on credit rating agency liability 126

3.6.1 Four basic factual situations 126

3.6.2 Loss suffered by issuers 127

3.6.3 Loss suffered by investors 129

3.7 Concluding remarks 132

4 PRIVATE INTERNATIONAL LAW ASPECTS 135

4.1 Introductory remarks 135

4.2 Characterisation 137

4.3 Jurisdiction 138

4.3.1 Legal framework 138

4.3.2 Formal, material and temporal scope of Brussels I Regulation (recast) 139

4.3.3 Jurisdiction agreements 140

4.3.3.1 Remarks in advance 140

4.3.3.2 Jurisdiction agreements in favour of courts of Member States 141

4.3.3.3 Jurisdiction agreements in favour of courts of third countries 147

4.3.4 General ground for jurisdiction 153

4.3.5 Special ground for jurisdiction 154

4.3.5.1 Matters relating to tort 154

4.3.5.2 Handlungsort 156

4.3.5.3 Erfolgsort – financial loss 159

4.3.5.4 Erfolgsort – reputational loss 174

4.4 Applicable law – Rome II Regulation 177

4.4.1 Scope of application 177

4.4.2 Choice of law agreement 181

4.4.3 General rule 182

4.4.3.1 Financial loss 182

4.4.3.2 Reputational loss 186

4.4.4 Escape clause 187

4.5 Recognition and enforcement 187

4.5.1 A small sidestep to recognition and enforcement 187

4.5.2 Enforcement within EU 188

4.5.3 Depletion of assets in the EU 188

4.6 Concluding remarks 191

5 INTERPRETATION AND APPLICATION ARTICLE 35A UNDER DUTCH, FRENCH, GERMAN AND ENGLISH LAW 195

5.1 Introductory remarks 195

5.2 Methodology 196

5.2.1 Approach 196

5.2.1.1 Three parts 196

5.2.1.2 Part 2: Comparison through functional method 196

5.2.1.3 Part 3: Comparison through terms and subjects 198

5.2.1.4 Presentation of the legal comparison 199

5.2.2 Legal systems involved 200

5.2.3 Challenges in the field of legal sources and language 202

5.3 Terms and subjects of Article 35a 204

5.3.1 Article 35a (1) 204

5.3.1.1 Preliminary considerations 204

5.3.1.2 ‘Intentionally’ or ‘with gross negligence’ 210

5.3.1.3 ‘Impact’ and ‘caused to’, including claimant-specific requirements 211

5.3.1.4 Suffering ‘damage’ and claiming ‘damages’ 217

5.3.2 Art. 35a (3) – Limitations of liability in advance 219

5.3.3 Prescription 221

5.4 Dutch law 222

5.4.1 National private law context 222

5.4.2 National rules on credit rating agency liability 224

5.4.2.1 Little attention to credit rating agency liability 224

5.4.2.2 In the presence of a contractual relationship – issuers & investors 225

5.4.2.3 In the absence of a contractual relationship 226

5.4.3 Article 35a (1) 236

5.4.3.1 ‘Intentionally’ or ‘with gross negligence’ 236

5.4.3.2 ‘Impact’ and ‘caused to’, including claimant-specific requirements 245

5.4.3.3 Suffering ‘damage’ and claiming ‘damages’ 256

5.4.4 Article 35a (3) Limitations of liability in advance 263

5.4.4.1 General system 263

5.4.4.2 Limitations of liability in relation to issuers and investors 268

5.4.5 Prescription of claims 269

5.4.6 Concluding remarks 271

5.5 French law 272

5.5.1 National private law context 272

5.5.2 National rules on credit rating agency liability 275

5.5.2.1 Liability regime prior to 2018 275

5.5.2.2 In the presence of a contractual relationship – investors & issuers 282

5.5.2.3 In the absence of a contractual relationship – investors & issuers 283

5.5.3 Article 35a (1) 284

5.5.3.1 ‘Intentionally’ or ‘with gross negligence’ 284

5.5.3.2 ‘Impact’ and ‘caused to’, including claimant-specific requirements 287

5.5.3.3 Suffering ‘damage’ and claiming ‘damages’ 294

5.5.4 Article 35a (3) Limitations of liability in advance 303

5.5.4.1 General system 303

5.5.4.2 Limitations of liability in relation to issuers and investors 305

5.5.5 Prescription 306

5.5.6 Concluding remarks 307

5.6 German law 308

5.6.1 National private law context 308

5.6.2 National rules on credit rating agency liability 310

5.6.2.1 Much attention to credit rating agency liability 310

5.6.2.2 In the presence of a contractual relationship 311

5.6.2.3 In the absence of a contractual relationship 312

5.6.3 Article 35a (1) 327

5.6.3.1 ‘Intentionally’ or ‘with gross negligence’ 327

5.6.3.2 ‘Impact’ and ‘caused to’, including claimant-specific requirements 330

5.6.3.3 Suffering ‘damages’ and claiming ‘damages’ 343

5.6.4 Article 35a (3) Limitations of liability in advance 348

5.6.4.1 General system 348

5.6.4.2 Limitations of liability in relation to issuers 351

5.6.4.3 Limitations of liability in relation to investors 353

5.6.5 Prescription of claims 354

5.6.6 Concluding remarks 356

5.7 English law 358

5.7.1 National private law context 358

5.7.2 National rules on credit rating agency liability 361

5.7.2.1 Approach UK Implementing Regulations 361

5.7.2.2 In the presence of a contractual relationship – issuers & investors 362

5.7.2.3 In the absence of a contractual relationship 362

5.7.3 Article 35a (1) 374

5.7.3.1 ‘Intentionally’ or ‘with gross negligence’ 374

5.7.3.2 ‘Impact’ and ‘caused to’, including claimant-specific requirements 375

5.7.3.3 Suffering ‘damage’ and claiming ‘damages’ 390

5.7.4 Article 35a (3) Limitations of liability in advance 398

5.7.4.1 Limitations of liability towards issuers – solicited ratings 398

5.7.4.2 Limitations of liability towards issuers – unsolicited ratings 398

5.7.4.3 Limitations of liability towards investors – with and without subscriptions 399

5.7.5 Prescription of claims 401

5.7.6 Concluding remarks 401

5.8 Comparison 403

5.8.1 Remarks in advance 403

5.8.2 National bases for civil liability – comparison 404

5.8.2.1 In the presence of a contractual relationship 404

5.8.2.2 In the absence of a contractual relationship 405

5.8.3 Article 35a (1) CRA Regulation – comparison 407

5.8.3.1 ‘Intentionally’ or ‘with gross negligence’ 407

5.8.3.2 ‘Impact’ and ‘caused to’, including claimant-specific requirements 410

5.8.3.3 Suffering ‘damage’ and claiming ‘damages’ 419

5.8.4 Article 35a (3) CRA Regulation – Limitations of liability in advance – comparison 424

5.8.5 Prescription of claims (comparison) 428

5.8.6 Conclusions related to the legal comparison 429

5.9 Concluding remarks 432

6 OBSERVATIONS AND RECOMMENDATIONS 435

6.1 Introductory remarks 435

6.2 Normative framework 436

6.3 Observations within the normative framework 440

6.3.1 Limited added value Article 35a 440

6.3.1.1 Added value in theory, limited added value in practice 440

6.3.1.2 Narrow scope of application and stringent conditions 442

6.3.1.3 Structure 444

6.3.1.4 Unintended effect: decreased issuer and investor protection under French law 449

6.3.2 Private International Law rules leave uncertainty 450

6.3.2.1 Focus on three main issues 450

6.3.2.2 Exclusive jurisdiction clauses in favour of third country courts 450

6.3.2.3 Erfolgsort of financial loss 453

6.3.2.4 Erfolgsort of reputational loss 457

6.3.3 Uncertainty relating to interpretation and application terms Article 35a 457

6.3.3.1 Sources of uncertainty 457

6.3.3.2 Imprecise drafting & unclear status terms 458

6.3.3.3 Friction 460

6.3.3.4 Uncertain application of national legal concepts 462

6.3.4 Little convergence 463

6.3.4.1 Differences between four legal systems investigated 463

6.3.4.2 Continuing risks of regulatory arbitrage 466

6.4 No adequate right of redress 467

6.5 Recommendations 468

6.5.1 Remarks in advance 468

6.5.2 Possible structures of EU provisions on civil liability 469

6.5.2.1 Three options 469

6.5.2.2 Option (a) Requiring application of national civil liability regimes 470

6.5.2.3 Option (b) Imposing detailed obligations upon Member States 471

6.5.2.4 Option (c) Extending Article 35a 472

6.5.2.5 Competence, subsidiarity and proportionality 473

6.5.3 Private International Law rules 475

6.5.3.1 Continuing importance PIL 475

6.5.3.2 Limit validity exclusive jurisdiction clauses third country courts 475

6.5.3.3 Relevant connectors and location of financial loss 477

6.5.4 Further substantive guidance 487

6.5.4.1 More guidance, in a balanced manner 487

6.5.4.2 Reasoning from justification for civil liability and duty of care credit rating agencies 488

6.5.4.3 Defining standard of care and attribution (issuer claims and investor claims) 490

6.5.4.4 Amending requirement of reasonable reliance (investor claims) 491

6.5.4.5 Linking credit rating agency’s duty and the recoverable loss of investors (investor claims) 492

6.5.4.6 Limitations of civil liability in advance (issuer claims and investor claims) 496

6.6 Rating the suitability of Article 35a’s template for private enforcement 497

6.7 Concluding remarks 499

REFERENCES 505

INDEX 553

Anderen die dit e-book kochten, kochten ook

Net verschenen

Rubrieken

- aanbestedingsrecht

- aansprakelijkheids- en verzekeringsrecht

- accountancy

- algemeen juridisch

- arbeidsrecht

- bank- en effectenrecht

- bestuursrecht

- bouwrecht

- burgerlijk recht en procesrecht

- europees-internationaal recht

- fiscaal recht

- gezondheidsrecht

- insolventierecht

- intellectuele eigendom en ict-recht

- management

- mens en maatschappij

- milieu- en omgevingsrecht

- notarieel recht

- ondernemingsrecht

- pensioenrecht

- personen- en familierecht

- sociale zekerheidsrecht

- staatsrecht

- strafrecht en criminologie

- vastgoed- en huurrecht

- vreemdelingenrecht